Enough to Thrive: Wealth That Leaves Room to Live

Rethinking What It Means To Be Rich

Money Systems That Reward Simplicity

Space, Possessions, and Mental Clarity

Freedom, Investing, and Optionality

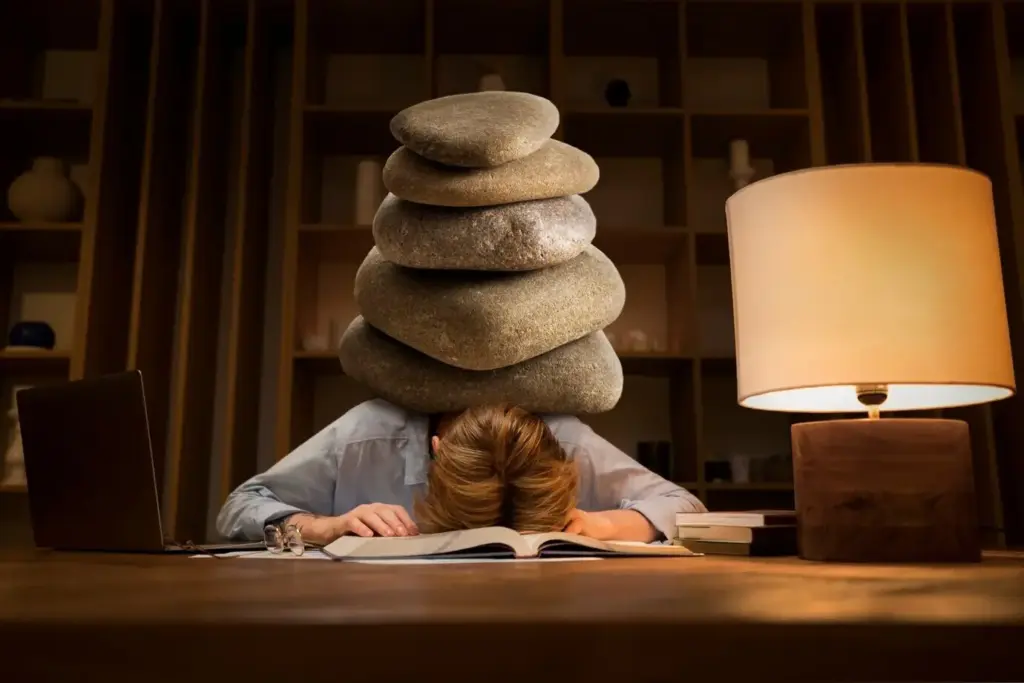

Build Margin Before Maximizing

Assets That Outlive Trends

Stories From Real Lives

Giving That Reflects Your Values

Instead of sporadic charity, build intentional giving into your plan, choosing causes you can support with money, time, and advocacy. Small, consistent contributions accumulate real impact. Transparency with family encourages shared purpose, and volunteering together turns generosity into a practiced habit that nourishes relationships alongside the communities you care about.

Teaching Enoughness to the Next Generation

Invite children into decisions: compare quality over quantity, tally opportunity costs, and celebrate repairs. Create rituals like toy libraries or clothing swaps to normalize circulation. By modeling gratitude and discernment, you equip them with financial literacy and emotional resilience, inoculating against advertising-driven envy with a deep sense of personal agency.

Sustainable Traditions Over Expensive Defaults

Replace obligatory extravagance with traditions that emphasize time, craft, and connection: handwritten letters, shared recipes, neighborhood potlucks, or annual hikes. These rituals scale beautifully, cost little, and age well. The legacy becomes stories and skills, not debt-fueled parties or storage units of forgotten decorations and seldom-used equipment.

A Seven-Day Sufficiency Sprint

Measure Joy per Dollar

All Rights Reserved.